Save over $1,300 with the 52-Week Money Saving Challenge & FREE Printable Savings Tracker

Disclosure: This post may contain affiliate links. Please read my Disclosure page for more information.

Struggling to save money? It’s okay, we’ve all been there. This 52-week money savings challenge helps keep you on track and your piggy bank full.

Saving money when you have a laundry list of financial obligations is a real headache. That’s why I’ve developed my own take on the tried-and-true 52-week savings challenge to help you stay on track towards your financial goals.

A Bankrate survey shows that 19% of Americans save zero (ZERO!) dollars! And another 21% report saving just 5%. Shocking isn’t it?!

Unfortunately, this is the sad truth for a lot of Americans. But here’s the catch, it doesn’t have to be! I’m sharing my take on the 52-week savings plan, complete with a free printable savings chart, to help you stay on track.

This incredible weekly savings plan has helped me save heaps of cash over the past five years. With some discipline and forward-thinking goals, you can save tons of money in just one year, too.

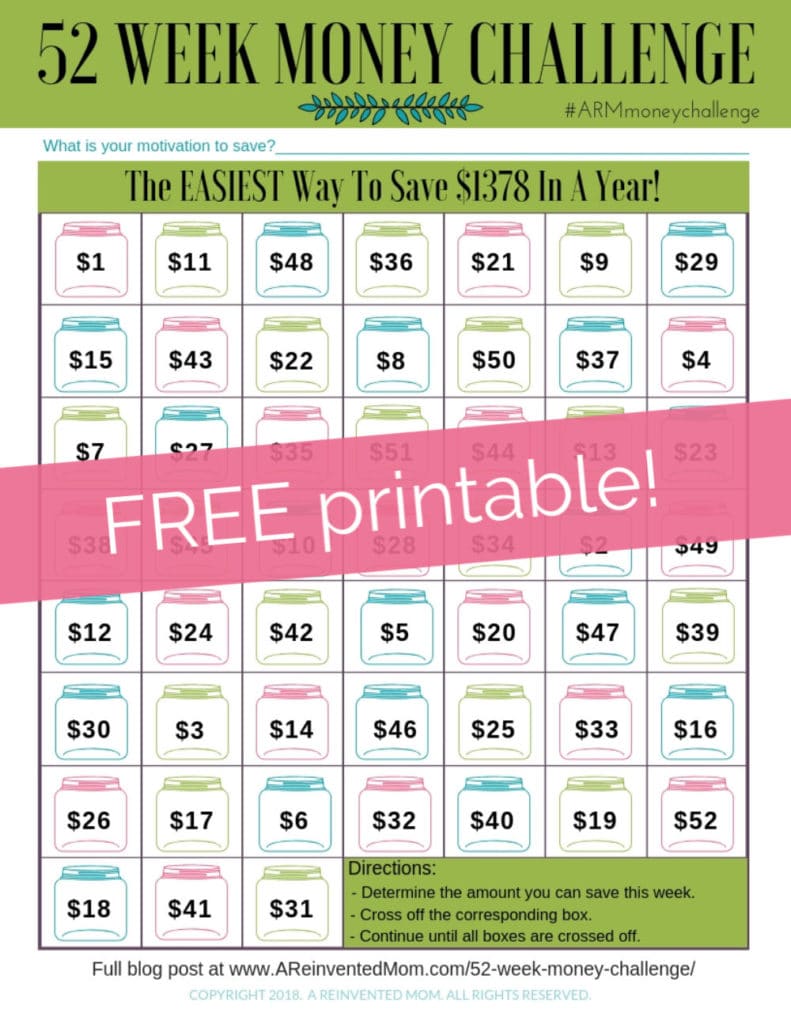

How to save $1378 with this 52 Week Money Savings Challenge

Saving over $1,000 in just one year starts with a single dollar. That’s it! The point of the plan is to build-up saving more and more over time.

However, to get started, all you need is the free 52 week money saving challenge printable tracker, a savings account and $1.

Perhaps you’ve had a few spendy months. Maybe it’s right after the holidays (oof!) or you had an unexpected medical bill to take care of.

Either way, overspending is all good until the credit card bills start rolling in. This is when having a 52-week savings plan comes in handy. That extra cash can really help you out in a pinch.

In order to start saving money, you’ve got to have a plan. That’s where the savings challenge comes in. First, identify your savings goal, then use the worksheet to hold yourself accountable for reaching that goal.

What Is The 52 Week Money Challenge?

This easy weekly savings plan has been around for a long time. And that’s because it works.

It’s a simple process, that takes some discipline, but it’s designed to help you learn to save more over time. I initially discovered it over 5 years ago and I’ve been successfully saving money ever since.

The 52 Week Money Challenge is one of the easiest ways to jumpstart your savings habit. The premise is simple: save a pre-determined amount of money every week, starting small and working your way up to larger sums.

Following the plan helps you develop regular savings habits. Sounds easy enough, right?

You can start with as little as one dollar per week. Over the course of the year, the challenge bumps your weekly savings contributions up until you are saving over $50 a week!

The first year, I had socked away $1,378.00!!! An amazing result that started with just a single dollar bill! That’s a great savings nest egg.

How to Use the FREE Printable Money Savings Chart Template

Over the years, I developed my own version of the 52-week money savings challenge and created a printable template to track my progress. This easy-to-follow money savings worksheet is designed to instill solid savings habits over time.

First, identify your end goal and think about how you plan to save. Next, use the worksheet to hold yourself accountable and identify how much money you can save each week.

The result is a fool-proof weekly savings plan that results in healthy savings habits you can use year after year.

Step One: Identify Why You Are Saving Money

Without an end goal in mind, your apt to fail when times get tough. Set yourself up for success by identifying key reasons why you want to save money.

Use your goal as motivation. Write it down directly on the 52-week savings chart template to serve as a reminder throughout the year.

Maybe you want to start saving now for Christmas 2020. Just imagine how awesome it would be to pay CASH for all your holiday expenses! I can tell you first hand it feels GREAT not racking up debt over the holidays.

Perhaps you want to travel over the holiday. Start saving now to fund the trip. You can fully enjoy your vacation when you know you won’t be facing a mountain of credit card bills when you return home.

Or maybe you need to establish an emergency fund. Having an emergency fund is essential to covering life’s unexpected expenses. Whether it’s home or vehicle repair costs or medical expenses, you gain a certain level of security knowing you can pay these expenses without resorting to credit cards.

So, identify your “Why.” Write it down on the Tracking Sheet. And think about it every time you make a deposit. This is what will keep you motivated when the going gets tough.

Step 2: Plan How You Will Safe Keep Your Money

Before you start saving, think about where you will keep the money you’re saving for the 52-week money challenge. You want the location to be convenient for deposits but secure enough that you aren’t dipping into it for coffee money.

I don’t recommend comingling the funds with your household account. It’s too easy to spend your hard-saved funds on household expenses or entertainment.

If you have the strength to keep your hands out of the proverbial cookie jar, a simple container at home can be effective. This a great option for anyone who has a lot of cash on hand. I used an old hot cocoa tin the first year I did the challenge.

Another great option is to set up a new bank account, to be used solely for your 52-week money challenge funds. Like the “cookie jar” storage option, you need to have a “hands-off” mindset with this account.

Whether you stash your cash in a jar or set up a separate account, select a plan that makes the most sense for YOU.

Step 3: Determine How You Will Make Deposits Into Your Account

The next step is to set up a way to deposit money into your savings jar. If you work in cash (perhaps you get tips at your job), then you should plan on putting money in the jar on a set day each week. I’ll be honest, this can be a bit of a hassle if you don’t plan ahead.

If you opted to deposit your funds in a bank account, make sure you transfer the funds as soon as you receive your paycheck. Use an alarm or calendar reminder on your phone to make sure you schedule your savings contributions.

The first rule: Pay yourself FIRST! Delaying the transfer could mean you’ll spend the money elsewhere and won’t be able to fund the weekly payment.

Treat your savings like you would any bill. It gets paid on time without question each month – no excuses! Just like you wouldn’t like the power to be turned off in your home, you wouldn’t want to skip out on feeding your piggy bank!

*** Pin the 52 Week Saving Plan & FREE Printable Savings Tracker for Later ***

How to Use the Printable 52 Week Savings Challenge Chart

Over the years, I’ve honed the 52-week savings challenge to create a money savings plan that works. I tweaked the original idea to be a bit more realistic and relevant to the average household saver.

And, most importantly, I’ve made the 52-week money challenge FUN! Because honestly, saving money should be fun! And I believe you are more likely to be successful if you enjoy the process.

So, I created a free printable savings tracker that allows flexibility while you save money.

The first thing you’ll notice is the dollar amounts aren’t in any particular order. I’ve eliminated fixed dollar amounts in particular weeks.

This is because some weeks are easier than others. If you’ve got a light week with expenses, save more! Think of it as a treat to your future self.

For tighter weeks, you still have to contribute, but you have the flexibility to select a smaller amount.

Second, the worksheet is laid out in grid form, similar to a Bingo board.

To get started, simply determine how much you will save the first week. If you don’t have much to spare, start with one of the lower amounts. If you’ve got a little extra money, consider depositing a larger amount.

Deposit the funds and cross off the corresponding number on the chart. Continue in this manner throughout the year, selecting amounts that haven’t been crossed off.

Save Money: The Ultimate Pantry Challenge Guide

This money savings method allows you to have control over the dollar amount you contribute weekly. The result is a flexible money savings challenge that increases your rate of success.

At the end of the year, all the numbers will be crossed off and you’ll have $1,378.00 saved!

Can I Use The Worksheet If I Am Paid Semi-Monthly Or Monthly?

Absolutely! If you are paid twice a month, simply select 2 boxes every paycheck. If paid monthly, select 4-5 boxes.

Again, this plan is flexible – YOU select the amounts to contribute.

Don’t be tempted to skimp out! Every week select something. Understand that if you start off with all low numbers, you’ll need to contribute higher amounts at the end.

Do I Have to Start The Challenge on January 1?

No. You can start the 52-week money challenge at any time.

If you are a week or two into the new year, select a couple of make-up squares and you’ll be on track to finish by the end of the current year.

You can even start the challenge mid-year. There are no rules that state the 52 weeks have to begin in January.

The important thing is to simply begin saving.

Who Should Participate in the 52 Week Money Challenge?

Anyone can participate in the challenge. The 52-week savings challenge is an excellent way to teach kids and teens healthy money-saving habits. However, you might want to dial back the amounts based on their earning abilities.

The printable 52-week money challenge is tailor-made for anyone who:

- wants (or needs!) to start a savings plan.

- needs structure to ensure savings success.

- wants to fund a large purchase (travel, holiday gifts, etc.).

- needs to create an emergency fund.

My Experience with the 52 Week Saving Plan

After a few VERY challenging years financially, I was finally in a position to begin saving a little money. But I was having a difficult time getting the savings ball rolling.

That was also the year I pledged to find a way to pay for next year’s Christmas gifts in CASH.

I faced several obstacles to achieving that goal. My job wasn’t stable. And I had large debts I was paying off. Call me overwhelmed!

What was I thinking?! I stalled out thinking of hurdles rather than solutions.

After I completed my first savings challenge, I was totally hooked. It was the exact thing I needed to hold myself accountable and save away.

The Downside of the 52 Week Money Challenge

I’m going to be honest – it’s not a perfect plan. And it wasn’t always easy – saving money is hard work for some of us!

If you’re self-employed it’s often difficult to gauge how much money you’ll be able to put away each week. Some weeks you may have nothing, so don’t get discouraged if you don’t receive a steady income.

Related: Save $500 in 30 Days

Just stick to rule one: pay yourself first. You’ll find that even just having a worksheet that helps you think about saving money, can go a long way to encourage healthy finance habits.

Additionally, if you don’t save big throughout the year, you’ll find you need to save quite a bit in December. For many of us, that’s a spendy season and you’ll end up in a cash crunch.

Skirt this issue by opting to save higher dollar amounts during low-spending months. That way you won’t fall off the wagon come December.

Overall the 52-week money saving challenge has good bones. This method is great for those who need a tool to be held accountable.

The 52-week money challenge allowed me to establish good savings habits during a difficult time in my life. Good habits that continue to serve me well today.

If I can do it, so can you!

Let’s Get Saving!

A weekly savings plan can be an effective way to initiate good savings habits. Especially for those of us who struggle saving money on a regular basis.

Are YOU ready to make a fresh start in the New Year?

Are YOU ready to take control of your financial future by planning ahead?

NOW is the time to make a commitment to get on the path to saving money regularly.

Download your FREE printable 52-week savings plan worksheet today!

Want to track your savings plan progress? Grab the FREE money saving chart by clicking the link below.

*** FREE 52 Week Money Saving Challenge Printable Template ***

More Money Saving Posts:

- Easy Ways to Use Leftover Party Food

- 7 Steps to Stick to Your Christmas Budget

- How to Host Thanksgiving on a Budget

This article was originally posted on 12/28/18 and updated on 12/27/19.